Website maintenance

We will be doing maintenance to our website and online forms between Friday and Monday. If you have problems using our online forms, please try again later. more »

Housing Benefit Decision Notice frequently asked questions

This short video may help you to understand your Housing Benefit letter. We have answered some other common questions below the video. The video is also available in Urdu and Slovak.

Why have I received a benefit decision notice?

How much Housing Benefit will I get?

How much rent do I have to pay?

What are non-dependant deductions?

How is my Housing Benefit Paid?

Who do you pay my Housing Benefit to?

How often is my Housing Benefit paid?

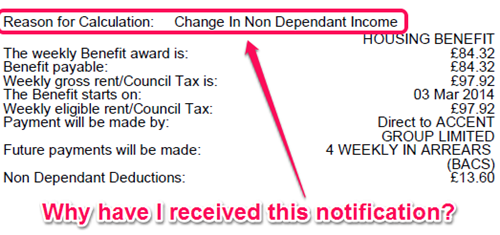

Why have I received a benefit decision notice?

The reason for each person’s notice can be found next to Reason for Calculation.

If the reason says Annual Uprating, this just means there has been a change to your benefits due to the Government’s annual review of benefits and allowances.

There may be other reasons relating to a change in your circumstances which will mean a decision notice is sent to you.

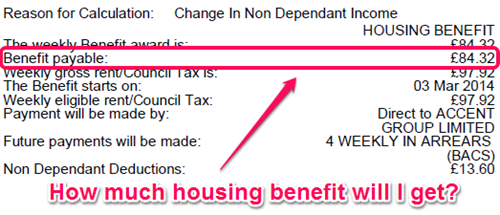

How much Housing Benefit will I get?

We will pay the amount on the ‘Benefit payable’ line.

How much rent do I have to pay?

We cannot tell you how much rent you pay – that is for your landlord to do.

Generally, you need to pay the rent your landlord charges, minus the benefit we pay you. For example:

- your landlord’s rent £500

- take off your benefit £200

- you pay £300

But you may have to pay extra if you are in arrears. Also we pay benefits every two weeks or every four weeks, but your rent agreement may cover different periods. Only your landlord knows your particular circumstances.

What are non-dependant deductions?

A non-dependant is someone over 18 who normally lives with you but doesn’t pay rent. This could be a friend or member of the family such as grown up children or parents living with you.

We take a fixed amount from your Housing Benefit and/or give you a smaller Council Tax reduction based on the weekly income, before tax, of your non-dependants.

We make these deductions whether the non-dependant contributes to your household or not.

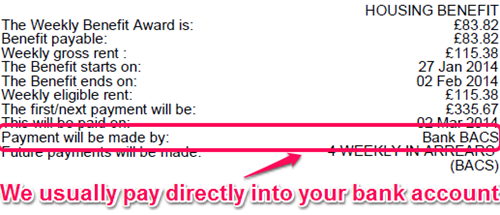

How is my Housing Benefit Paid?

Housing Benefit will usually be paid directly into a bank account by an electronic system called BACS. In some circumstances we may make payments by a cheque.

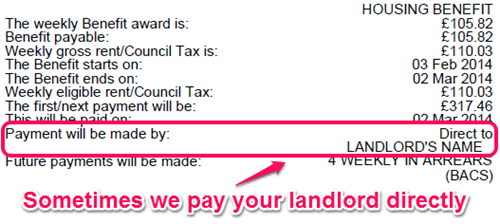

Who do you pay my Housing Benefit to?

In most cases, if you rent your property from a private landlord, Housing Benefit is paid to you.

In some cases we make payments direct to your landlord and your decision notice will say Direct to [Landlords name].

How often is my Housing Benefit paid?

Housing Benefit is paid either every two weeks or every four weeks. Payments are made in arrears which mean that payments cover the previous two or four weeks.

What is an Applicable Amount?

An applicable amount is the minimum weekly amount of money the Government says that you and your family need to have a basic standard of living. The applicable amount will depend on your age, circumstances and who is in your household.

What is disregarded income?

This is part of your weekly income that we do not count when we are calculating your Housing Benefit and/or Council Tax Reduction.