Benefits Notification explained

The council's benefits team sends notifications to households who receive benefits from us (for example Council Tax Reduction). These notifications explain what benefits you receive from the council, how much you will receive and when to expect your payments.

When will I receive a benefits notification?

If you receive Council Tax Reduction (CTR) only, we will only send you a benefit notification once a year (usually around April time).

However, you can keep up to date with your benefits account by signing up to MyInfo. This allows you to access up to date details of your claim at any time.

Your benefits account - sign up to MyInfo

How to understand your benefits notification

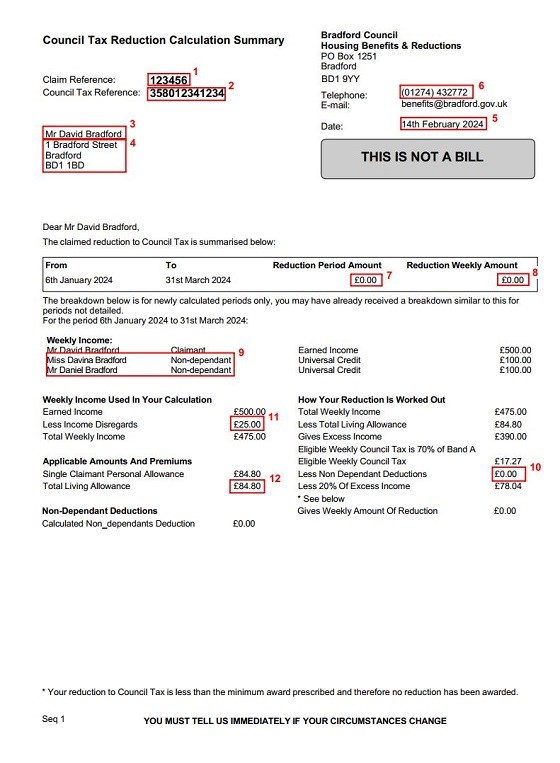

Our full explanation of your Benefits Decision Notice will help you to understand it better. Please see the numbered explanations below:

- Your Benefits reference number - always quote this number when you contact us.

- Your Council Tax reference number - always quote this number when you contact the Council Tax department.

- The person who has been designated to receive the Benefit Decision Notice.

- The address where we are sending the Benefit Decision Notice.

- The date the Benefit Decision Notice was issued.

- Contact telephone number - if you have any queries about your Benefit claim, you can phone this number.

- Reduction Period amount - this is the amount of Council Tax Reduction (CTR) you have been awarded for this period.

- Reduction Weekly amount - this is the amount of CTR you have been awarded per week.

- Non-Dependants - this shows anyone over 18 who lives with you (excluding your partner).

- Non-dependant deduction - this is any deductions we make from your benefit because of the income of your non dependant.

- Disregarded income - this is any income that we don’t take into account.

- Living Allowance – this is the amount of money that the government says that you and your family need to have a basic standard of living after household costs have been taken in to consideration. These figures are set by the government each year.